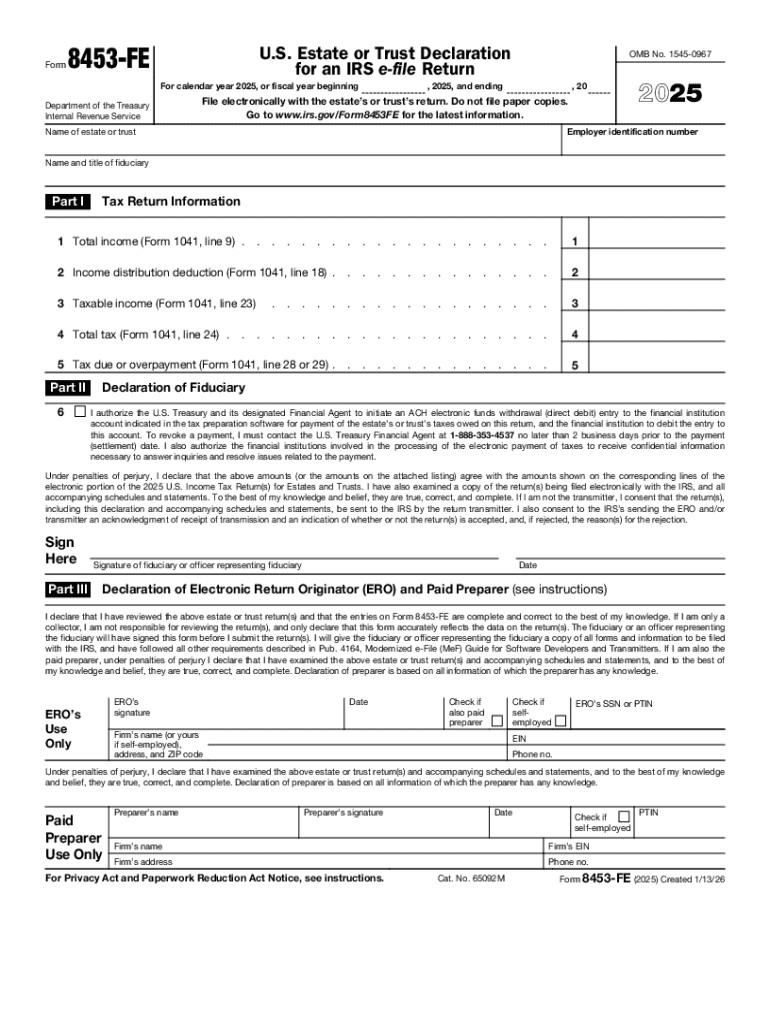

IRS 8453-FE 2025-2026 free printable template

Instructions and Help about IRS 8453-FE

How to edit IRS 8453-FE

How to fill out IRS 8453-FE

Latest updates to IRS 8453-FE

All You Need to Know About IRS 8453-FE

What is IRS 8453-FE?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8453-FE

What should I do if I realize I've made a mistake after submitting IRS 8453-FE?

If you discover an error after filing IRS 8453-FE, you can submit a corrected version along with a detailed explanation of the changes. This is important to ensure your records are accurate and comply with IRS regulations. Always keep copies of your previous and corrected submissions for your records.

How can I check the status of my IRS 8453-FE submission?

To verify the status of your IRS 8453-FE, you can use the IRS online tools available for tracking your e-file status. Be mindful of common rejection codes that may prompt required actions, and keep a record of your submission details to assist in your inquiry.

What are some common errors when filing IRS 8453-FE, and how can I avoid them?

Common mistakes when filing IRS 8453-FE include incorrect information entries and failing to supply required signatures. To avoid these errors, double-check all information for accuracy and verify that all required sections are completed prior to submission.

Is an e-signature acceptable for IRS 8453-FE, and what are the requirements?

Yes, e-signatures are generally acceptable for IRS 8453-FE, provided they comply with IRS requirements for electronic signatures. Ensure you use approved software or platforms that meet the necessary security standards to protect your data.